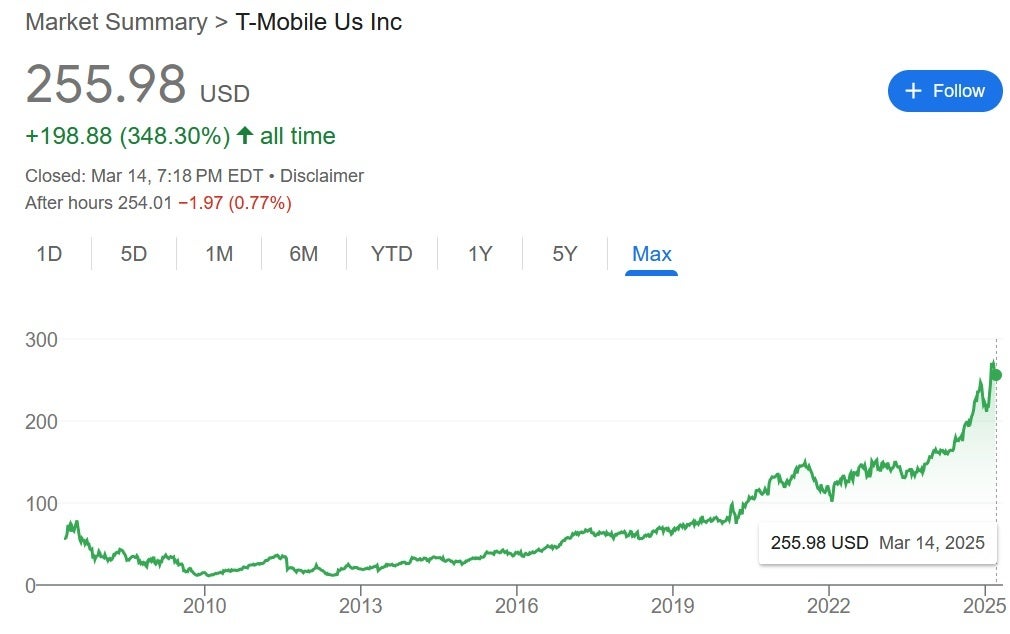

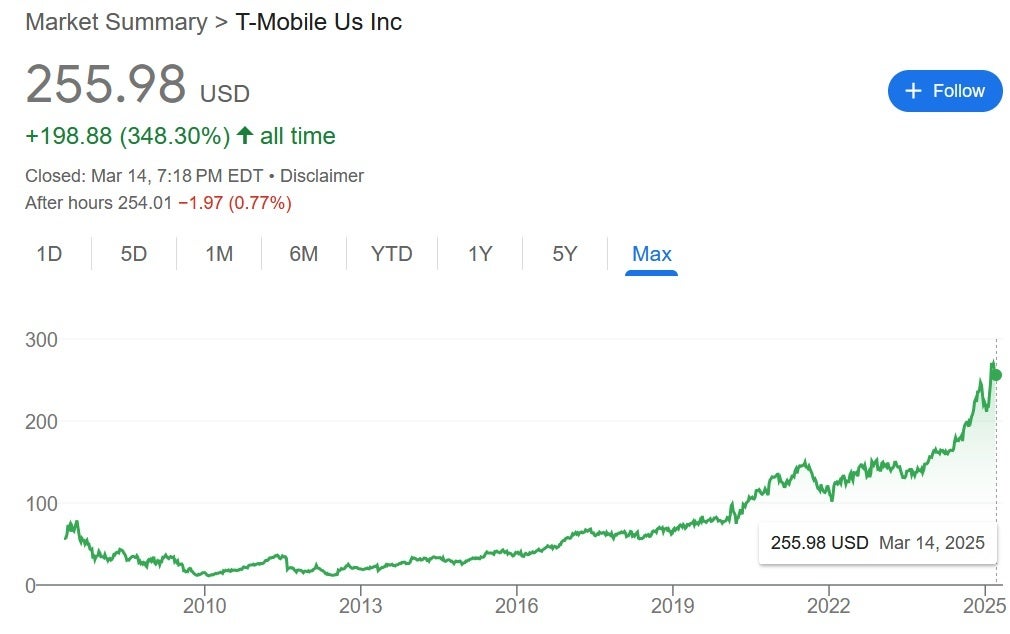

[ad_1] Since reaching the highest level in 52 weeks at $ 276.49 last month, T-MobileThe shares of more than 20 dollars per week fell by $ 255.98. The shares fell 3.12 dollars (1.2 %) during regular trading hours on Friday. After Friday hours, the stock decreased more ($ 1.97 or 77 %) to $ 254.01. What determined the sale was a translation in T-Mobile Inventory by City analyst Michael Rollins, who said that the days of the carrier that surpasses its competitors may end soon. Rollins cut T-Mobile To keep the purchase while maintaining its target price of $ 268. The transition to the target will lead to a 3 % increase in the shares of the company. It was a long and profitable T-Mobile. | Yahoo's financial credit. One way that T-Mobile It can reduce this installment without declining shares by increasing its share in the market or by obtaining a major cable company. Sexy like this acquisition T-MobileCiti's Rollins says such a receipt may likely end T-MobileThe growth and mitigating the growth of higher revenues significantly. During the past year, T-MobileIts shares rise by 58.2 %, which is higher than 55.9 % AT & T And 10.33 % earns that Verizon I took. S&P 500 rises by 7.2 % during the same time period. With the market value of $ 293 billion, T-Mobile It is the most valuable of the three major wireless companies based on the maximum market. AT & T It is worth $ 190.7 billion, followed by $ 183.4 billion Verizon It is estimated at. Talking about AT & TThe company's shares got a snapshot in its arm yesterday when they received a promotion from Raymond James Frank Luthan. The latter confirmed the rating of his strong purchase on the stock, while raising its target price to $ 29 from 28 dollars. The arrow is already in a gentle bullish direction and gives you 4.18 % profit distributions while waiting for the stock height.

[ad_2]

Download

T-Mobile gets downgraded and the shares responded just as you’d expect they would

| Name | |

|---|---|

| Publisher | |

| Genre | News & Magazines |

| Version | |

| Update | March 15, 2025 |

| Get it On |  |